Everything about 3 Things To Avoid When Filing Bankruptcy

Attending Counseling Before you decide to file, you’ll be needed to go to a counseling session by using a credit counseling organization authorised because of the U.

The main gain to this plan is usually that it keeps any consideration of residence foreclosure from the table. In truth, filing Chapter 13 stops foreclosure proceedings.

In the event you have real estate and also have a mortgage, odds are your property finance loan agreement has an acceleration clause. A lot of people don’t understand what an acceleration clause is. Mainly because it’s element of your respective mortgage contract, it’s fantastic for getting accustomed to it.

All information and facts, which include prices and charges, are precise as of your date of publication and so are up to date as supplied by our associates. Some of the features on this web page may not be readily available by means of our Web page.

At the time a creditor wins a cash judgment, the lien legal rights accompanying it will permit the creditor to garnish your wages, attach your lender accounts, repossess your automobile, and foreclose on the house.

No matter if you decide bankruptcy is good for you or not, Conference by using a nonprofit credit history counselor may also help you figure out The simplest way to attack your credit card debt and rebuild your credit score.

And not using a subpoena, voluntary compliance within the part of your World-wide-web Assistance Supplier, or additional documents from a third party, info saved or retrieved for this link objective on your own are not able to usually be accustomed to discover you.

By clicking “I Agree” you consent to our Conditions of Services, agree not to make use of the data provided by Recordsfinder.com for just about any illegal functions, and you find here simply realize that we are not able to affirm resource that information and facts offered down below is correct or finish.

As a result of financial hardship Many individuals are dealing with now a result of the pandemic, many lenders are permitting borrowers to atone for their delinquent bank loan payments.

It’s very stressful to imagine getting a letter of acceleration and most likely shedding your house in foreclosure. It’s important to understand that In most cases, lenders would A great deal instead work with borrowers to settle their financial debt than go throughout the foreclosure course of action.

Some individual merchandise and house are exempt from bankruptcy proceedings. These typically drop underneath the heading “necessary to live.” Therefore someone’s property and motor vehicle probable will likely be exempt along with apparel, appliances and computers or other goods required with the occupation.

You might want to take into consideration taking a 2nd position or offering some property to help pay down debt. Also, take wikipedia reference a tricky examine your credit card debt. Is there a means to lessen desire or charges? Could it be A short lived scenario or a longer-phrase trouble?

You'll find, of course, disadvantages to filing for bankruptcy, starting up with the obvious: Your credit rating score following bankruptcy is going to get A serious hit – you may get rid of among a hundred and 200 factors – that gained’t get better quickly.

The lawyer or regulation organization you happen to be calling is just not needed to, and will pick never to, take you as a customer. The Your Domain Name web will not be automatically protected and emails sent through This website could possibly be intercepted or go through by third events. Thank You.

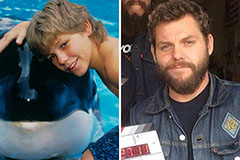

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Shannon Elizabeth Then & Now!

Shannon Elizabeth Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Morgan Fairchild Then & Now!

Morgan Fairchild Then & Now!